If you're familiar with Funraise, you know that we believe that the best companies (like Funraise!) are born from leaders whose products address issues that the founders themselves have faced. Innovation is often driven by a frustration with inaccessibility, a desire to dismantle the status quo, and a passion to shake up the system. Nonprofit fundraising is no different—innovating the marketplace to drive user experience and increase donor engagement is key to increasing nonprofit revenue.

That’s where Steve Latham comes in.

With a background in technology, finance, and social good, Steve started DonateStock to create ease in the nonprofit donor experience and facilitate the transfer of stock donations to create a world where everyday investors of diverse economic backgrounds and income levels can become nonprofit donors. That's something we can all get behind.

Steve recently brought Stock Donating 101 to Funraise's Nonstop Nonprofit podcast—and it was such a helpful breakdown that we pulled all the essential information from that conversation, delivering you a streamlined explanation of how everyone wins with stock donations. Plus, how Funraise is teaming up with DonateStock so that you can win, too.

Here's the #1 secret about donating stock that will turn donors' heads

In short, you can avoid the capital gains tax on the stock that you donate, and then you also get to itemize the full tax deduction of the market value.

Steve gets right to the point: If you've been sitting on stock for ten years, and it appreciated 5X or 10X, you can save a lot of taxes while giving nonprofits a larger pretax gift.

If it's that easy, why don't more people take advantage of stock donating?

It was just more hassle than it was worth.

Steve's experience was laughable in this time of technology. He had to figure it out from scratch, researching, making calls, sending faxes (whaaaa?!), filling out forms. All of this took hours of work—just to make a pretax, managed gift.

So he didn't go through the process again. Until he discovered that no one had jumped on this opportunity to make stock donating easy through technology. And that was what sparked Steve's inspiration to solve this shouldn't-be-a-problem problem for donors.

Before DonateStock, it was just as painful for nonprofits to accept stock donations

Many organizations don't accept stock donations because of the perceived effort it takes, both on the organization side and also the donor side. Nonprofits bear a heavy burden in this biased and broken process. Steve notes,

Historically, there are, I'd say, two major problems that nonprofits face.

One is access.

Brokerages have a really difficult time opening accounts for small nonprofits; unfortunately, they have a high-risk propensity for either malfeasance or fraud or just sometimes, just bad financial management. nonprofits.

The other problem is nonprofits generally don't build assets.

Nonprofits use their brokerage account to receive the stocks, sell the stock, and move the cash out to their operating account or their endowment fund. Which means there's not really any money in it for the brokers, but there is a cost.

What about nonprofit organizations that already have a brokerage account?

Nonprofits that have brokerage accounts have a different set of challenges in that there are several big problems with stock. One is the painful process Steve already explained. But it doesn't stop there.

One of the major problems with receiving stock donations through traditional means is transparency. Steve explains why that's a problem for nonprofits on two fronts.

The way that stock transfers through this archaic financial system, it takes days to happen. There's no transparency. And then when stock hits the nonprofit's brokerage account, the nonprofit has no idea whose stock it is.

For example, if you didn't tell a nonprofit that you were donating 50 shares of Apple, the nonprofit would have no idea where that gift came from.

And that's the big disappointment for a lot of donors: "I just made this really nice gift to you, and I'm waiting for you to thank me, send me a note, maybe give me a call." Instead, it's just crickets until the donor reaches out months later asking for a tax receipt.

By that time, it's been a bad experience for the donor, so they're not very inclined to do it again.

And if the donor comes to you before they make the stock donation, it's usually because they need guidance through the maze-like giving experience. In that case...

...nonprofits have to kind of walk them through that process; educate them. And most nonprofits really aren't that comfortable at telling anybody how to do a stock gift; it's just kind of something they're just not very well versed in.

It's amazing that anyone would even donate stock given those hoops you have to jump through!

That's where DonateStock comes in.

Let's backtrack to that lack of transparency problem. You may be thinking that you can just keep a spreadsheet of stocks that come in... it'll be easy to know who gifted which stocks. Steve has seen how that plays out—let's see what usually happens.

A lot of people donate the same stocks: Apple, Microsoft—stocks that people have owned for decades. Imagine that a bunch of people are all donating Apple stock to a nonprofit; they see Apple coming in ten shares here, five shares there, ten shares there. They don't know whose stock is whose and they literally have no way of knowing whose stock it is.

Yikes. That is definitely a problem.

So the nonprofit has to go back to the donor and say, "We got a bunch of Apple stock, but we're not sure which is yours. Can you tell us if the shares actually left your account?"

With such a difficult process, how common is stock donating?

Historically, the majority of nonprofits that say, "Yes we do receive stock gifts" actually mean "Yeah, cause we have a board member that likes to give us a big gift every year so we have to receive stock."

Despite that, households generally have 10X more in their investment account than they do in their checking accounts, maybe more, especially in larger network households. It's a bigger pool, and it's more tax-advantaged for the donor. But it's just been really hard to get at, or it's just been locked up for decades. Those are the problems that we set out to solve.

10X... what are the other stats around stock ownership?

It's about 60 million investors.

Wow. Tell us more.

Roughly over half of U.S. households actually own stock. If you think of 60 million investors, if every investor donated $1,600 a year in stock to nonprofits, that would be $100 billion in funding for nonprofits. Individual giving last year (2021) was close to $300 billion.

So, how did DonateStock solve this problem and make it easier for nonprofits to accept stocks?

First, we just make it easy for the donor.

Starting off strong...

In just a matter of minutes, a donor can click on a DonateStock button on the nonprofit's site, enter their information, and provide their brokerage details. We don't ask for a username or login. We're not asking for their credentials; just the information needed, and then the securities they want to donate to that charity. And that's it.

We'll take that data, send it to their broker, and facilitate the transfer of the stock to that nonprofit.

But then we also let the nonprofit know. We send them an email: You're going to get this gift that Justin is sending you 50 shares of Apple worth $7,500. So they now know "Justin Wheeler just made a stock gift to me. It's enroute." Because it takes days to go through the financial system, it's not instantaneous like we're accustomed to.

That's if their nonprofit has a brokerage account.

What if the nonprofit doesn't have a brokerage account?

Glad we asked! DonateStock already thought of that.

Now if they don't have a brokerage account or frankly, don't have the team to process all of these, we created our own 501(c)3, DonateStock Charitable, so we can actually convert that stock to cash for the nonprofit and just send them the proceeds through ACH.

And that's overwhelmingly what they what they prefer.

We can turnkey this entire process for nonprofits who are either resource-constrained or just so busy pursuing the mission that they don't have the time for this.

So at the end of the day, every nonprofit can receive stock. DonateStock removes friction, both for the donor as well as for the nonprofit.

What's going to be the catalyst that will make this a more mainstream giving method?

Awareness. Very few investors are aware of the benefits of charitable stock gifting. It's one of the best-kept secrets in personal finance and has been for decades.

Once they understand the benefits, generally people say, "Why do I not know this? And now that I do, why would I give cash? If I have appreciated stock, it's financially irresponsible to give cash, so why don't I just start giving more stock?"

And then once they do it, they can go to their dashboard and repeat that transaction really easily. There's like 60 seconds to do it the second time. Then it just becomes a new way people to give.

We think that over time that's how we go from roughly 1% or 2% people donating stock of investors today to 5%, 10%, 15% over the next five years.

Is there any way to get financial advisors involved in generating this catalyst?

DonateStock makes it easy for advisors to initiate stock gifts on behalf of their clients. In a couple of minutes, advisors can initiate a gift on behalf of the client and have a dashboard of all the gifts they've initiated for all of their clients. Steve explains:

We view the financial advisor channel as really the best way to educate donors because ultimately, as a fiduciary, you should be telling your clients about tax-advantaged ways to give. They've been kind of loathe to do that because charitable stock giving is a lot of work for the advisors. So like, no good deed goes unpunished.

One of DonateStock's goals is to try to help them become more self-sufficient; that way, advisors can be better fiduciaries. Be more outspoken in advising their clients without it burdening them with a ton of work to do that they don't get paid for.

How's it working out?

Steve has a great example to illustrate the results of spreading awareness.

One of our nonprofit clients was having their big annual gala. They put a note in their response card: "You can use stock to bid on the auction items," and their grand prize for the live auction was a weekend in Montana with Cole Hauser, who plays Rip on Yellowstone. So one of their benefactors informed the people who run this nonprofit, she said, "I'm just letting you know, I'm going to outbid anybody for this prize. I'm going to win this auction as long as I can use stock." Do you know how much that went for?

How much was it?

$220,000 for this event.

And, honestly stock enabled it. The way she did that was with stock she's had forever.

And that's that's just one example.

There's another organization in Miami. I was speaking there and the nonprofit signed up. They put an email out to their to the board and their donors. And literally, within a week, they got a $50,000 gift. Another one called Channeling Partnership announced it and got a $100,000 gift within a week. There are so many great stories out there.

Speaking of examples, Funraise's CEO and Co-founder, Justin Wheeler has one, too. In Justin's words:

I host an annual gala for an organization that I sit on the board of, and last year we were doing a cash auction. We always start with the highest gift amount, which that night was like 100 grand.

And we asked, "Can anyone tonight donate hundred thousand dollars?" And, to your point, most people, especially savvy investors, have much more in their investment accounts than in their checking accounts.

And no one's raising their hand. And I flippantly said, "We accept stock donations if that changes the game," and a couple of hands went up and donated 100,000 plus in stock.

Is DonateStock seeing an effect from new technology that facilitates casual stock investing?

We see potential.

To clarify the benefit of avoiding Capital Gains tax: you have to have held the stock for a year. So if you buy GameStop and then a month later want to donate it, you wouldn't get the same tax benefits.

What we are seeing is that studies show that the younger generations are much more generous in their mindset. 67% of millennials identify themselves as charitable people. Where it's like one-fourth of that if you ask boomers. So, you know, it's a very different generational mindset about social awareness and social responsibility.

And there are more people because of the ease of getting into investing, because of all that happened during the pandemic—all the stimulus money—and people stayed at home and started investing.

They're learning, and they're getting the taste for it. So there's definitely a groundswell of younger investors that are very charitable and benevolent that as they acquire meaningful assets are going to be really a huge force for stock gifting over the next decade or two.

Got any data that relates to that younger generation of investor donors?

If you remove the outliers and normalize charitable stock gifting through DonateStock, it's about $5000 as an average, but about $2000 as a median. And I think over time we'll see that probably go down.

An average gift of $2-5000, compared to the sector-wide average online credit card donation of $120 is impressive.

What broader market trends with stock gifting is DonateStock seeing?

Holding periods

What's interesting is that most of the stock that people are donating are five, ten year holding periods. So ten years ago, for reference, Apple on split adjusted basis was about 10-12 bucks. Today [2022] it's down, right? It's at under $150, but it's still up 12X the last ten years.

Concentration issues

And investor donors have a concentration issue, like, "Hey, my Apple stock now is a really big share in my portfolio; I need to harvest some gains. I need to reduce some of my exposure." Gifting is a great way to do that.

Health of the stock market

Obviously, when it's a healthier stock market, it's going to be better for stock gifting. But we're still seeing donations come in every day. Not a lot of Roku is being donated right now, but we still see a lot of energy stocks and long-term Microsoft.

Seasonality

The other thing, seasonally... November, December is better now than it is because that's when most stock gifting takes place. More so than other types of gifting, people who are doing their year-end, looking at like taking their tax loss, harvesting on their stocks, like selling their losers to offset gains.

I think the number is around something like 30% of donations come in in November, December, across all donations. But for stock, it's going to skew much higher just because of that year-end planning taking place.

Can stock gifting through DonateStock get any better?

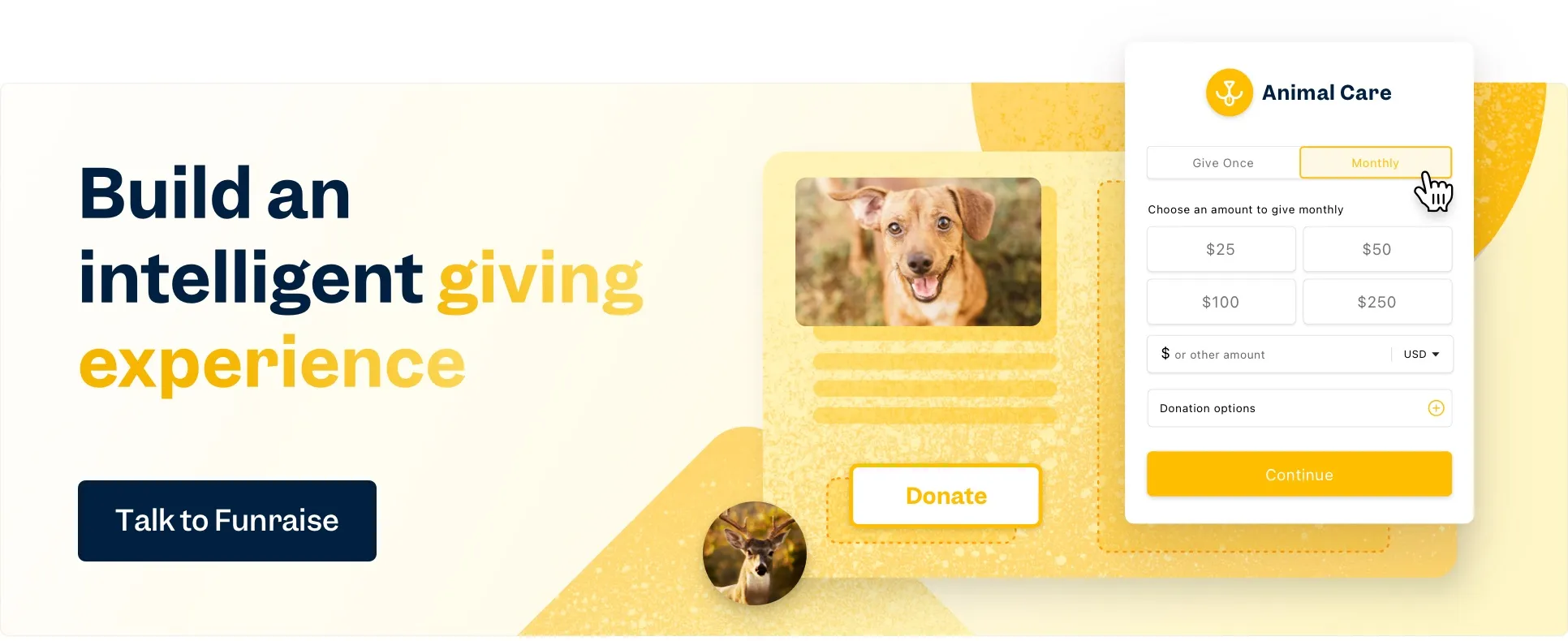

Heck yes, stock gifting is available through the DonateStock integration with Funraise's Giving Form. Funraise works with thousands of nonprofits; millions of donors have given through Funraise's platform.

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)