You’ve probably heard a lot of buzz around donor-advised funds, or DAFs, lately. They’re growing in popularity! They’re just for the wealthy! They’re not regulated enough! They’re really just 10 raccoons in a trench coat!

Whether you’ve bought into the hullabaloo or not, DAFs are here to stay. In 2021, contributions to DAFs totaled nearly $72.7 Billion while grants from DAFs to nonprofits totaled over $45.7 Billion. And over the past five years, both these numbers have steadily (and impressively) increased year-over-year to reach record highs (National Philanthropic Trust). With that in mind, we’re going to cut through the DAF noise (carefully, so as not to upset the raccoons) and dig into the whole truth, and nothing but the truth, about DAFs.

What is a DAF?

A DAF, or donor-advised fund, is a private charitable investment account used solely to manage donations to nonprofit organizations. Individuals, families, or organizations can add funds, assets, or securities to the account as often as they’d like, then recommend when and where to distribute them.

What’s the difference between a DAF and a private foundation?

While DAFs and private foundations have a lot in common, they’re more like second cousins than twins. Sure, there are some surface similarities, but there are also substantial differences between the two. With a DAF, the donor contributes money or assets to a fund managed by a sponsoring organization. With a private foundation, however, the donor manages the funds themselves. That means they’re responsible for start-up costs, staffing, and legal matters. For donors, the choice usually boils down to how much control they want over their funds, if they’re mostly there for the tax benefits, and whether they want to give anonymously.

For nonprofits, there’s a crucial difference: the annual required payout for foundations is 5%, and their average payout hovers just above that. DAFs, however, have an average annual payout of around 20% (SSIR). That’s a big difference.

How do donor-advised funds work?

Basically, a donor contributes money, assets, or securities to their DAF, which is run by a sponsoring organization. The donor takes the tax deduction, watches the earnings grow tax-free, and, when they’re ready, distributes the funds to a worthy cause—or causes—of their choice.

Want to know more? Here’s a step-by-step breakdown of the full DAF process.

- Invest in a DAF

- Decide which DAF is right for you

- Establish your DAF

- Contribute to your DAF

- Work with your DAF

- Grow your DAF

- Pick nonprofits to support

- Distribute DAF funds

1. Decide to invest in a DAF

First, an individual, family, or organization decides to establish a donor-advised fund. Great idea!

2. Research sponsoring organizations

Donors have a lot of choices when it comes to who manages their DAF. In fact, estimates suggest that there are more than 1,000 sponsoring organizations out there today. Depending on their preferences, donors can take that moolah to a community foundation, a single-issue nonprofit, or a national investment house’s charitable arm, like Fidelity or Schwab. The choice depends on a number of factors, like how much flexibility the donor wants, minimum contribution requirements, and admin fees. But 70% of DAF grants go through national charities, with community foundations and single-issue nonprofits accounting for just 21% and 9% respectively (National Philanthropic Trust).

3. Reach out and establish a DAF

Once the donor chooses a sponsoring organization, they can sit back while the sponsoring org handles all the legwork.

4. Contribute cash or other assets

With the DAF set up, donors can get donating. Note well, however, that once they’ve contributed to their DAF, it’s a lifetime commitment. While they can take as long as they want to distribute the funds, they can’t use them for any purpose other than giving to a nonprofit organization.

5. The donor advises; the organization manages

The sponsoring organization handles all the logistics while the donor advises them on how to distribute the funds and when. Just as with other investments, DAF donors can play it safe or take on some risk.

6. The DAF grows (hopefully!) tax-free (definitely!)

While the donor figures out what to do with their fund, the fund grows … or doesn’t, depending on market conditions and how much those big risks paid off.

7. Pick nonprofits to support

Donors can support any registered nonprofit organization with their DAF.

8. Distribute funds

When the donor is ready, they can advise the sponsoring organization to distribute the heck out of those funds. Then, they go directly to the chosen nonprofit organizations. And … scene.

What can you give to a donor-advised fund?

Did you notice our nod to “other assets” in the section above? Well, it’s true! One of the great things about DAFs is that a donor can contribute all sorts of non-cash assets. And they really love those nontraditional assets! In 2021, 66% of contributions to Fidelity Charitable DAFs were in the form of non-cash assets, with 55% of those consisting of publicly traded securities (Fidelity Charitable).

That being said, the specific types of assets that a DAF will accept can vary depending on the sponsoring organization. Generally speaking, however, accepted assets include:

- Cash.

- Stocks and bonds.

- Mutual fund shares.

- Employer contributions.

- Private equity interests.

- Money from 401ks or IRAs.

- Life insurance.

- Real estate.

- Cash equivalents, like a wire transfer or check.

- Cryptocurrencies.

Benefits of DAFs

While DAFs have their fair share of issues, they have a lot of nifty benefits for nonprofits and donors alike. As a result, the majority of nonprofits are embracing them. A 2020 survey from IUPUI found that 70% of nonprofits surveyed had received gifts from a DAF in the past three years (IUPUI). Here are some reasons to get in on the DAF fun.

Benefits of DAFs for nonprofits

- Potentially raise more. While funds can sit in a DAF for a while, that also means they have the potential to grow. Generally, invested assets grow faster than inflation, which means once the donor distributes the funds, your organization gets more. Additionally, donors get a ton of tax breaks with DAFs, so they may consider giving those extra bucks to your cause instead. And finally, while donors generally give less during economic downturns, if they’ve already committed funds to a DAF, they’ll likely keep giving.

- Get a head-start on estate planning. Donors can incorporate their DAF into their estate planning. That’s good for beneficiaries and good for nonprofiteers like you, who no longer have to write “In case you’re thinking about your death!” outreach letters. Ugh, those are the worst.

- Save admin time. DAFs streamline the donation process, cutting down on your extensive to-do list. Once a donor makes a grant recommendation, the sponsoring organization takes over. They put in the hours; you get the donation—done and done.

- More assets, more options. Because donors can easily contribute non-cash assets to DAFs (see our helpful list above), nonprofits get access to all sorts of donations. Donors can use DAFs to contribute appreciated securities, real estate, and other non-cash assets, which gives nonprofits greater flexibility in how they accept donations.

- No transaction fees. While the sponsoring organization does charge donors management fees, they’re generally low, and nonprofits themselves don’t pay anything to receive the funds.

- Time to think. While you might want that money ASAP, it can be good for donors to take a beat before making big decisions about charitable giving. They can give based on long-term needs rather than what’s in the headlines and ensure they’re doing their due diligence by supporting change-making organizations—like yours!

Benefits of DAFs for donors

- An immediate tax break. When a donor moves money or assets into a DAF, they get an immediate tax break. So, they can give $500,000 now and get a ginormous deduction this year rather than giving $100,000 for five years and taking five smaller deductions. (They’re a very rich donor!)

- Give flexibly. Give cash or give assets, give now or give later, give one big chunk or give smaller gifts over time. With a DAF, donors can donate however they want, whenever they want.

- Even more tax breaks. In addition, donors don’t pay capital gains taxes on donor-advised funds. And, for the few individuals who pay estate taxes, putting that money in a DAF can reduce that load, too.

- Less paperwork, more time. Making 20 separate charitable donations means a lot of paperwork, including separate gift acknowledgments from every one of those organizations. With a DAF, donors just get a single consolidated tax receipt.

- Give anonymously. For donors who value their privacy, it’s easy to contribute to a DAF anonymously.

- Make a lifetime (and beyond) commitment. Donors can incorporate their DAF into their estate planning to amplify the impact of future giving. Plus, they can add family members to their accounts as secondary advisers, getting the whole fam involved and teaching the kiddos to give back.

Drawbacks of DAFs

“Wow, DAFs are win-win!” you might be thinking. Not so fast, friend. Here are the DAF downsides.

- A lot of money just sits around. There’s about $160 Billion sitting in DAFs in the US. Right now, the IRS doesn’t require any minimum DAF payouts, so while the amount granted to charities each year is increasing, so is the total “balance.” That means billions of dollars collecting dust and tax savings rather than doing good (Nonprofit Quarterly). Put another way, a 2021 study found that DAFs may have cost charities $300 Billion dollars over five years (Boston College Law School Forum on Philanthropy and the Public Good). That’s … really a lot.

- Donors give, taxpayers subsidize. When a donor contributes money to their DAF, they get a tax deduction right away, which is great for them! But that deduction is subsidized by the American taxpayer by up to 74 cents on every dollar (inequality.org). That’s less great.

- Less data for you. Because the sponsoring organization is the intermediary for DAF donations, DAFs allow donors greater privacy when giving. Alas, that means nonprofits don’t have easy access to the (Probably rich! Potentially generous!) donors themselves, making it hard to build those all-important supporter relationships. Note, however, that just 5% of DAF grants are anonymous, so this isn’t a huge issue for most nonprofits (American Endowment Foundation).

- Anonymity=less scrutiny. Respecting people’s privacy is one thing, but the anonymity of DAFs can also hide less scrupulous giving practices, such as giving to controversial or political causes, or organizations that purport to do one thing while actually doing another.

- Donor fees. Nonprofits don’t have to pay any fees for DAFs, but donors still do—and those fees can add up. Generally, national sponsors charge admin fees of about 0.6% of total DAF assets, while investment fees are all over the map. As the assets grow, fees decrease, but as we all well know, any money spent on fees means less money for nonprofits.

- They’re still mostly for the wealthy. While DAFs are growing more accessible, many still have minimum contribution requirements, locking out less affluent donors from a plethora of tax benefits. The average DAF size grew by 9% from 2020 to 2021, from $167,748 to $182,842 (National Philanthropic Trust). If we’re about equity, we need to take a hard look at all systems that make the wealthy ever wealthier.

All the latest DAF news that’s fit to print

The regulations around DAFs are always changing, and it can be tricky to keep up with what’s what. While Congress didn’t pass the Accelerating Charitable Efforts (ACE) Act, aimed at accelerating payouts from DAFs to charities, there’s bound to be additional legislative efforts to get money to charities more quickly in the future. If you’re looking for a clear and succinct rundown of the ACE Act, Thomson Reuters has an excellent explanation. In the meantime, keep an eye on the headlines and always check the IRS website for the latest DAF requirements and regulations.

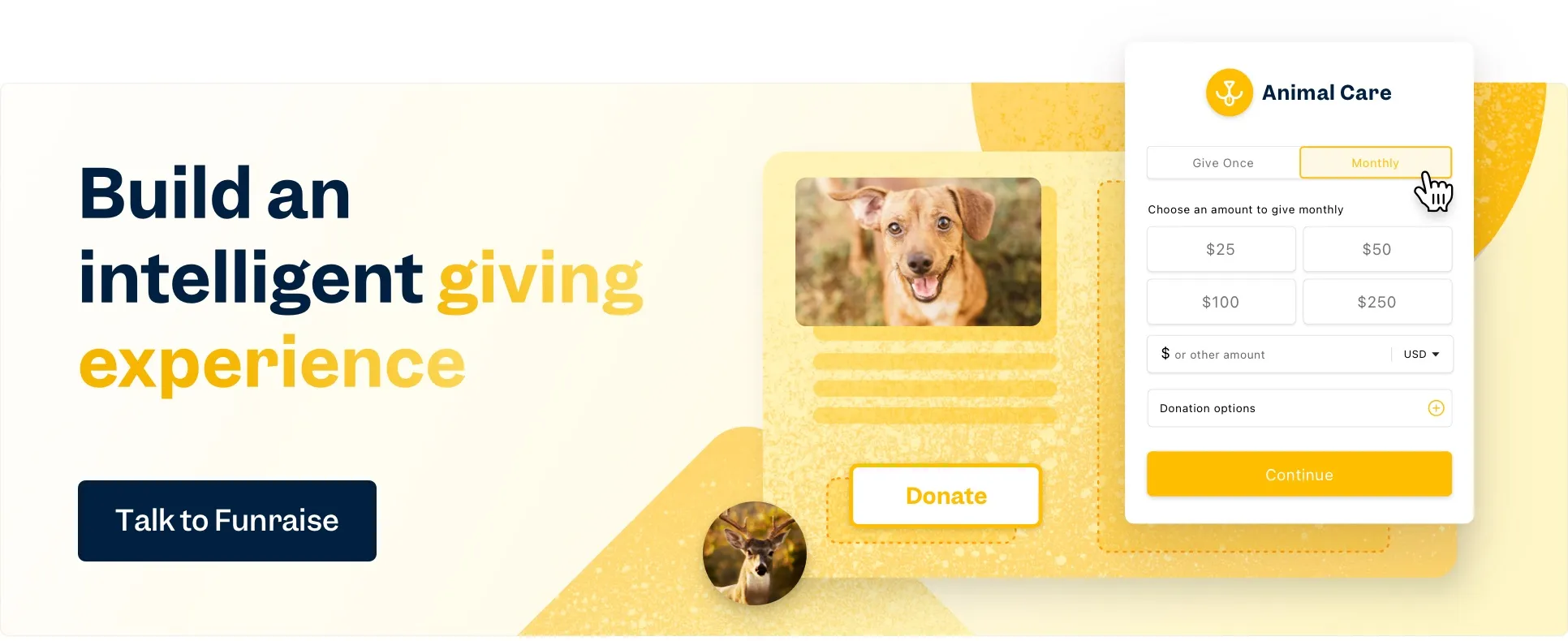

If you haven't participated in DAF Day, consider sending an email to your donor base asking for DAF donations—and if you have Funraise, you can offer them the easiest DAF giving experience ever through DAFpay by Chariot.

How to hook up with DAF donors

So, yes, there are pros and cons and complexities when it comes to DAFs, but considering how many donors use them, you want to be on the receiving end of those funds. But how do you do that if you don’t even know which of your supporters has a DAF? We’re so glad you asked.

- Ask DAFs for funds

- Ask donors if they have a DAF (or plan to establish one).

- Look for potential DAF donors

- Open conversations with DAF managers

- Keep your web presence up to date

- Make it easy to give via DAF

- Say thank you

1. Solicit DAF gifts

First and foremost, if you want to be on the receiving end of DAF funds, include DAFs in your fundraising outreach. A 2020 study by the Lilly Family School of Philanthropy found that 87% of nonprofits that asked for DAF gifts received one in the past three years, while only 42% of nonprofits that didn’t ask received one. So, shout your love of DAFs from the virtual mountaintops, on social media, in emails, and on your website.

2. Ask them

Just come right out and ask. You can send an email survey or work it into casual conversation (e.g., “Do you have a dog? Me, too! Do you have a DAF? I don’t. But we’d love to be included in yours!” So natural.)

3. Look for the signs

While (almost) anyone can establish a DAF, certain donors tend to gravitate toward them more. Keep an eye out for supporters who:

- Are wealthy, and particularly those holding additional real estate or LLC or limited partnership interests.

- Are frustrated by all the paperwork involved in giving to multiple charities.

- Operate a private foundation but are tired of the time commitment, cost, and complexity.

- Don’t have children.

- Are approaching retirement. According to Fidelity Charitable’s 2020 Giving Report, the average age of donors establishing a DAF was 55, and over half of DAF donors were 61 years old or older.

- Are concerned about privacy.

4. Focus on DAF managers

While many donors know what types of organizations they want to support with their DAFs, many have no idea, so they turn to the sponsoring organization itself. By cultivating relationships with these organizations as well as financial advisers, you can ensure you’re top of mind when they’re recommending grants. This works more for smaller community funds or foundations than than the big boys like Schwab or Fidelity. The idea is to apply for grants with your local community foundation to get on their radar. Then when the community foundation has

5. Get the word out

A lot of donors look to sites like Charity Navigator or GuideStar to choose impactful nonprofit organizations. Make sure your profile is fully up to date on these sites. At the same time, Google is always a favorite when it comes to researching charities, so keep that website looking spiffy.

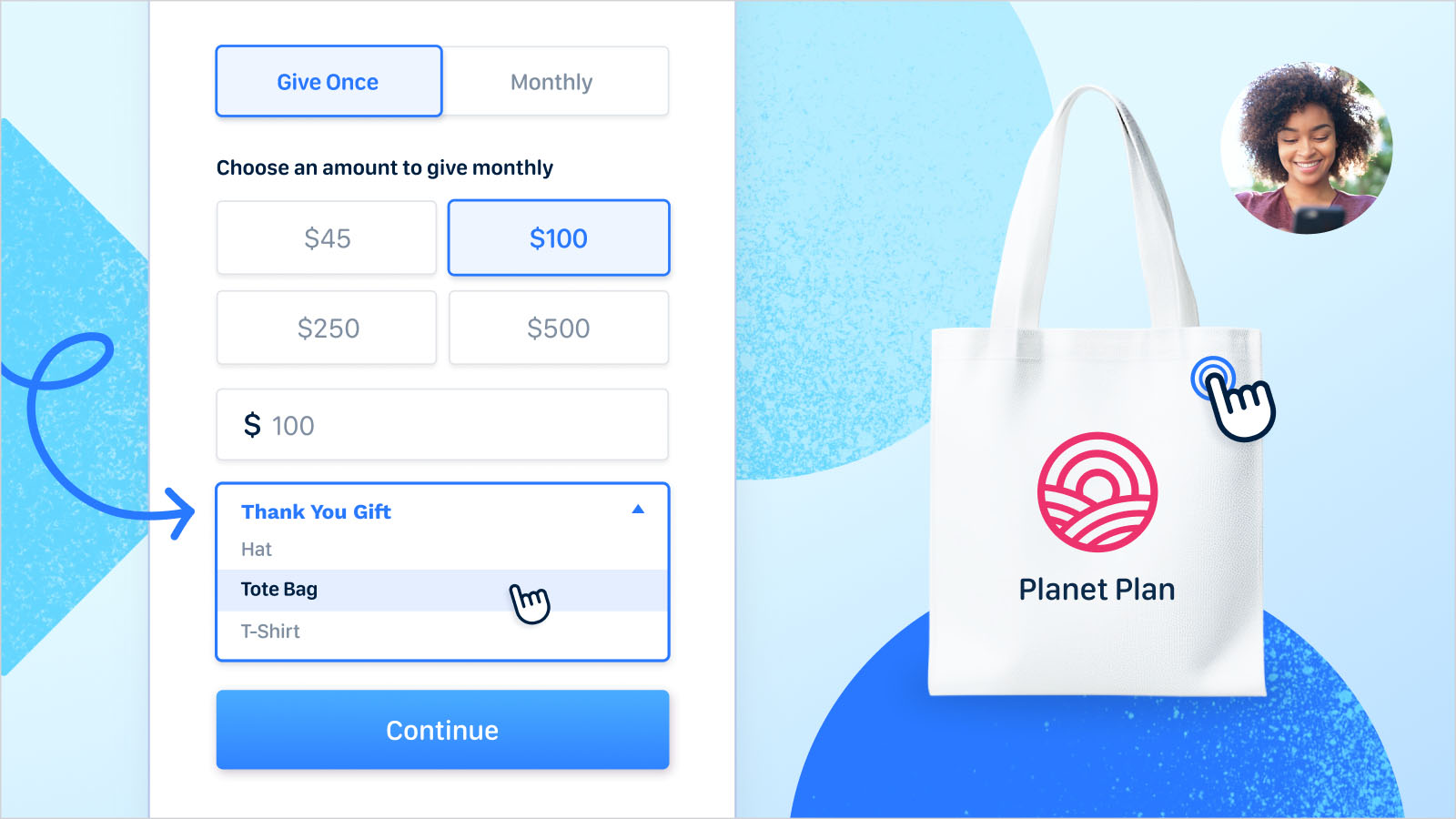

6. Make DAF giving easy

On your website, include clear directions on how to give through a DAF as well as resources to establish one for those who might be considering it. Additionally, talk donors through contributing and liquidating non-cash assets. The easier and more accessible you make it to give through a DAF, the less likely a DAF donor will go elsewhere.

Did you know that Funraise donation forms offer the easiest DAF giving experience in the world? DAFpay by Chariot takes DAF giving from weeks of frustration to a 3-click-and-go process—complete with donor data so you can build relationships that go beyond the gift.

7. Say thank you to everyone

As we’ve discussed, it can be hard to cultivate relationships with DAF donors. There’s the sponsoring organization that stands between you and the donor, plus there are donors who prefer to remain anonymous. So, cover your bases. Thank the sponsoring organization, reach out directly to the donors themselves, and say thank you over social media and on your website to check off those anonymous donors.

We hope we’ve supplied you with everything you ever wanted to know about DAFs—and then some. While they’re certainly a complicated issue, they’re not going anywhere soon. The good news? You’re a nonprofit, so you were built to adapt. It’s time to saddle up and settle in.

DAFs: Key takeaways

- DAF stands for “donor-advised fund,” which is a private charitable investment account used solely to manage gifts to nonprofit organizations.

- While DAFs and private foundations have a lot in common, there are several major differences, including minimum payout requirements, donor control, and the ability to give anonymously.

- DAFs have many tax benefits for donors. They can take an immediate tax deduction, avoid paying capital gains taxes, and reduce estate taxes.

- Donors can contribute cash and non-cash assets to DAFs, such as stocks, private equity interests, money from 401ks or IRAs, and real estate.

- For nonprofits, the main drawback of DAFs is that there’s no minimum payout amount, so money can sit in DAFs for years.

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)